5 6: Cost-Volume-Profit Analysis In Planning Business LibreTexts

These are expenses that a business has to pay, regardless of output levels. They can include rent or mortgage payments on business premises, utilities not directly linked to production, and salaries of admin or HR staff. CVP analysis helps management in finding out the relationship between cost and revenue to generate profit.

Ignoring the relevance of variable costs – The Most Common Errors That Can Arise When Analyzing the Results of CVP

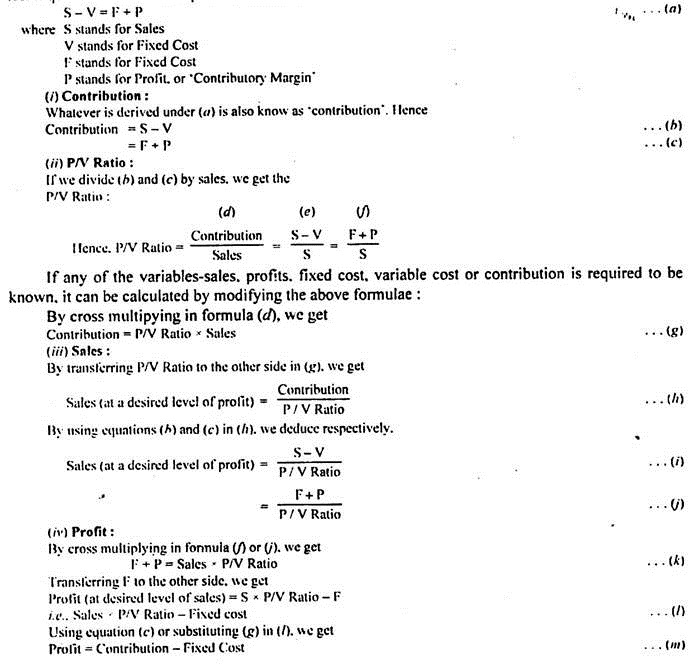

Understanding variable costs is essential for conducting Cost-Volume-Profit (CVP) analysis. CVP analysis helps businesses to understand the financial impact of different decisions, such as changes in sales volume, selling prices, or costs. Businesses can calculate their contribution margin by analyzing variable costs and determining their break-even point. Cost-Volume-Profit (CVP) analysis is a managerial accounting technique which studies the effect of sales volume and product costs on operating profit of a business. It shows how operating profit is affected by changes in variable costs, fixed costs, selling price per unit and the sales mix of two or more products. Businesses can use the contribution margin to make informed decisions about pricing, product mix, and resource allocation.

Cost Volume Profit Analysis (CVP) Explained

This includes economies of scale, changes in technology, and variations in customer demand, to name a few. This assumption’s violation can make the analysis results quite different from actual scenarios. Cost-volume-profit (CVP) analysis is an important tool that analyzes the interplay of various factors that affect profits. However, very few managers know about the profit structure in their own company or the basic elements that determine the profit structure. (1) The equation method A little bit of simple maths can help us answer numerous different cost‑volume-profit questions. The reality is, of course, that decisions such as staffing and food purchases have to be made on the basis of estimates, with these estimates being based on past experience.

Risk management and strategic planning

Connect and map data from your tech stack, including your ERP, CRM, HRIS, business intelligence, and more. Sync data, gain insights, and analyze performance right in Excel, Google Sheets, or the Cube platform. Cube’s AI automates the heavy lifting, letting your finance team focus on strategic insights. Using a tool like Google Sheets or Excel together with Layer can make your life much easier.

In this comprehensive guide, we’ll explore the concepts, applications, and best practices of CVP analysis to equip you with the insights you need for strategic planning. With a career spanning over a decade in the fintech industry, she leverages her expertise to drive strategic product marketing in the finance and FP&A tech space. Finally, you can calculate the margin of safety – in dollars or as a percentage of sales – to calculate how much sales could drop while still breaking even. When carrying out CVP analysis, it’s important to remember that it makes certain key assumptions that don’t necessarily reflect reality, at least in the long term. The margin of safety shows you how much your sales can drop while still allowing your company to break even. To find the margin of safety, simply subtract the break-even amount for sales from the actual sales for your company.

- Alternatively, the management may begin with a target profit and then work out the level of sales needed to reach that profit level.

- Variable costs may not stay constant per unit, and fixed costs might not remain unchanged throughout all levels of operations.

- The store can also use fixed costs for budgeting and forecasting to ensure that it can cover its expenses and generate a profit.

This is incorrect, as CVP analysis considers fixed and variable costs in analyzing profitability. The analysis of fixed costs is pertinent to determine the breakeven point, where the total revenue equals the total business costs. In summary, the contribution margin is the amount of revenue left over after variable costs have been deducted from the sales price of a product. It is an important concept in Cost-Volume-Profit (CVP) analysis and can help businesses make informed decisions about pricing, product mix, and resource allocation. (3) The graphical method With the graphical method, the total costs and total revenue lines are plotted on a graph; $ is shown on the y axis and units are shown on the x axis. The point where the total cost and revenue lines intersect is the break-even point.

A contribution margin income statement for the first year of operations is provided below. Compute net income assuming the selling price increases by 5%, variable expenses decrease by 0.45 cents per unit, and the irs hours of operation number of units sold increases by 12%. The foundational CVP formula provides a structured approach to assess how adjustments in these fundamental factors can influence an organization’s financial performance.

On the other hand, a decrease in volume could result in higher per-unit costs and lower profit margins, jeopardizing the financial health of the business. Great decision making in businesses is a product of powerful financial tools and analyses, among which the cost-volume-profit, or CVP, analysis holds a pivotal position. The crux of this line of analysis lies in understanding how variations in cost and volume impact the business profit, paving the way for strategic decision-making in various areas. While these assumptions may not hold strictly true in every real-life scenario, they do provide a baseline from which to begin the process of cost volume profit analysis. The principles outlined here provide a lens through which businesses can begin to understand the underlying behaviors and outcomes of their operations.